Understanding Lender Protection Insurance vs. Term Life Insurance for Canadian Homeowners

Understanding Lender Protection Insurance vs. Term Life Insurance for Canadian Homeowners

When buying a home, ensuring financial security for your loved ones is just as important as securing the property itself. Two key options often come into play for homeowners in Canada: mortgage insurance and term life insurance. While both serve to provide financial protection, they differ significantly in terms of coverage, benefits, and flexibility. Here, we delve into their distinctions and help you determine the best fit for your needs.

What Is Often Mistaken As Mortgage Insurance?

Mortgage insurance is often confused with the loan-default coverage offered by the Canada Mortgage and Housing Corporation (CMHC), which protects the lender if you default on your payments. This form of insurance is typically required when your down payment is less than 20% of the home’s purchase price. However, this is not the focus of this article. For more on CMHC insurance, visit them here: Canada Mortgage and Housing Corporation (CMHC) website.

What Is Mortgage Insurance?

In this article, mortgage insurance refers to the life insurance consumers buy to protect their families in the event of an unexpected death. Lender Protection Insurance, sold most often when you sign for your Mortgage and Fully Underwritten Life Insurance are discussed here. They have important differences that many Canadians might not have heard of before.

What Is Term Life Insurance?

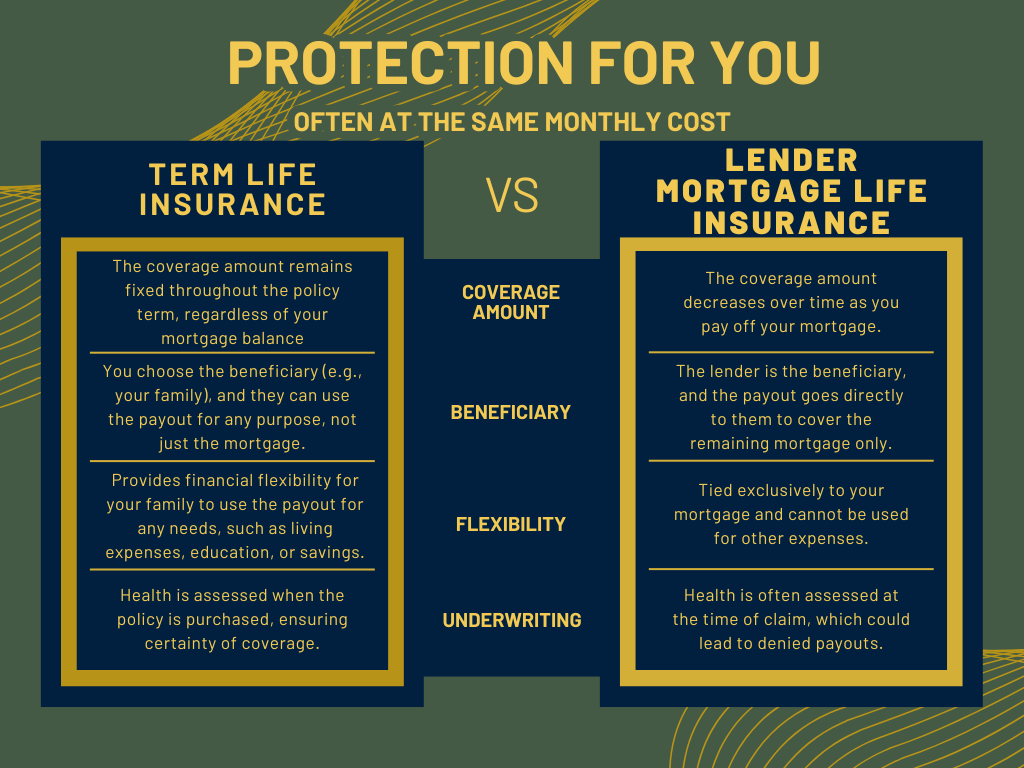

Term life insurance, on the other hand, is designed to provide financial support directly to your beneficiaries. This type of policy offers a predetermined payout (known as the death benefit) if you pass away during the policy term. Unlike mortgage insurance, term life insurance isn’t tied to a specific debt. Your beneficiaries can use the payout for any purpose, whether it’s paying off the mortgage, covering daily expenses, funding education, or investing for the future. You can learn more about term life insurance options by speaking with an advisor.

Claim Approval Rates

One critical distinction between these two options lies in claim approval rates. Term life insurance typically undergoes thorough underwriting at the time of application, where the insurer assesses your health and lifestyle. Once approved, the claim denial rate is low—approximately 4% in Canada, according to the Canadian Life and Health Insurance Association (CLHIA).

Mortgage insurance, however, often employs post-claim underwriting. This means your eligibility is assessed only when a claim is made. As a result, there’s a higher risk of claims being denied due to undisclosed health conditions or other factors. This uncertainty makes mortgage insurance less reliable for some homeowners. For insights into post-claim underwriting, visit Investopedia.

Coverage and Flexibility

Mortgage insurance coverage decreases over time as you pay down your mortgage, but your premiums typically remain the same. Furthermore, the payout can only be used to pay off the remaining mortgage balance, leaving no flexibility for other financial needs. For more on mortgage insurance specifics, check the Financial Consumer Agency of Canada (FCAC).

In contrast, term life insurance offers level coverage and premiums throughout the policy term. Beneficiaries receive a fixed death benefit that they can allocate as needed, providing greater financial flexibility and peace of mind.

How Common Are These Options?

While exact figures are hard to pin down, it’s estimated that a significant portion of Canadian homeowners have mortgage insurance, especially those with smaller down payments. On the other hand, about 57% of Canadian adults have some form of life insurance, including term life policies, according to studies by LIMRA and Life Happens. However, not all homeowners opt for term life insurance, often relying on group policies provided by employers or other financial arrangements.

Which Should You Choose?

The decision between mortgage insurance and term life insurance ultimately depends on your financial goals and personal circumstances. Here are some factors to consider:

Flexibility: Term life insurance provides more versatile coverage, allowing your family to decide how to use the funds.

Reliability: With pre-approved underwriting, term life insurance offers greater certainty in claim approval.

Cost: Compare the premiums of both options. In our experience, term life insurance often offers better value for the coverage provided. You can compare rates using tools like the InsuranceHotline comparison tool.

Control: Term life insurance benefits go directly to your beneficiaries, not the lender.

Conclusion

While mortgage insurance may seem like a convenient option tied directly to your home loan, term life insurance often provides more comprehensive and flexible protection for your family. By understanding the differences and weighing your options carefully, you can make an informed choice that ensures your loved ones are financially secure, no matter what the future holds. For further reading on financial planning, visit the Globe and Mail’s personal finance section or the Wealthsimple blog.

Click these words to book a mortgage insurance consult with one of our licensed advisors today.

Disclaimer: This content is for informational purposes only and should not be considered financial, tax, or legal advice. Independent Financial Broker makes no guarantees about the accuracy, completeness, or applicability of the strategies discussed. Always consult a licensed professional before making financial decisions. This article contains general information and illustrations intended to help Canadians make more informed choices. Any examples are for educational use only and do not guarantee future results.

Mitchell Wainman is a licensed Life and Accident & Sickness insurance advisor in Alberta, operating under Aurora Capital Partners.